The global fashion supply chain is changing faster than ever. A designer in Paris now collaborates with a pattern maker in Korea, sources (Source All types of Fabric Online) trims from Turkey, and fabrics from India or Italy. A boutique in Dubai may be selling gowns influenced by Lagos ceremonial fashion. A manufacturer in Mexico could be producing dresses inspired by Jaipur prints. The world of clothing is now a connected ecosystem, and fabric sourcing sits at the center of that system.

For decades, garment businesses relied heavily on local wholesalers, traders, and fragmented sourcing agents. While this worked in the past, it no longer fits the demands of today’s market. Brands now need more variety, faster sampling, personalized customization, transparent pricing, and culturally adaptable materials. Consumers in every country expect garments that reflect both identity and modernity. This shift has forced design teams, sourcing managers, and fashion entrepreneurs to rethink where and how they source fabrics.

Source All Types of Fabric Online for Your Garment Manufacturing

This is where FabricDiary offers a new model.

Not just a website selling textiles, but a curated B2B sourcing platform connecting global fashion houses, designers, and manufacturers directly to the mill-level production of Madhav Fashion Factory in India — one of the world’s largest textile innovation hubs.

In simple words:

You get factory-backed quality, with the flexibility of small orders, the catalog depth of a global wholesaler, and the personal support that creative businesses require.

Why Fabric Sourcing Needs a New Approach Today

The fashion industry has evolved beyond simple supply and demand. What sells is no longer just good fabric; what sells is fabric that fits cultural identity, trend psychology, climate suitability, and emotional value. A bridal gown in London does not carry the same meaning as a wedding dress in Lagos. Eveningwear in Riyadh is not styled like eveningwear in Milan. The blouse fabric worn in Mumbai during the monsoon cannot be the same as the evening sheath dress fabric for New York summer events.

Yet, most online fabric marketplaces treat all buyers as the same. They sell fabric, but not context.

And this is where sourcing problems begin:

• MOQ too high for small studios experimenting with new lines

• Minimal color or style variation in local wholesale markets

• Lack of transparency in online trading platforms like Alibaba, Etsy, Indiamart, TradeIndia

• Stylistic mismatch between available fabric and cultural usage

• Delayed deliveries and inconsistent quality checks

The result?

Designers compromise. Manufacturers settle. Brands lose identity. Consumers feel “something is missing”.

Fashion becomes repetitive instead of expressive.

FabricDiary exists to solve this exact gap.

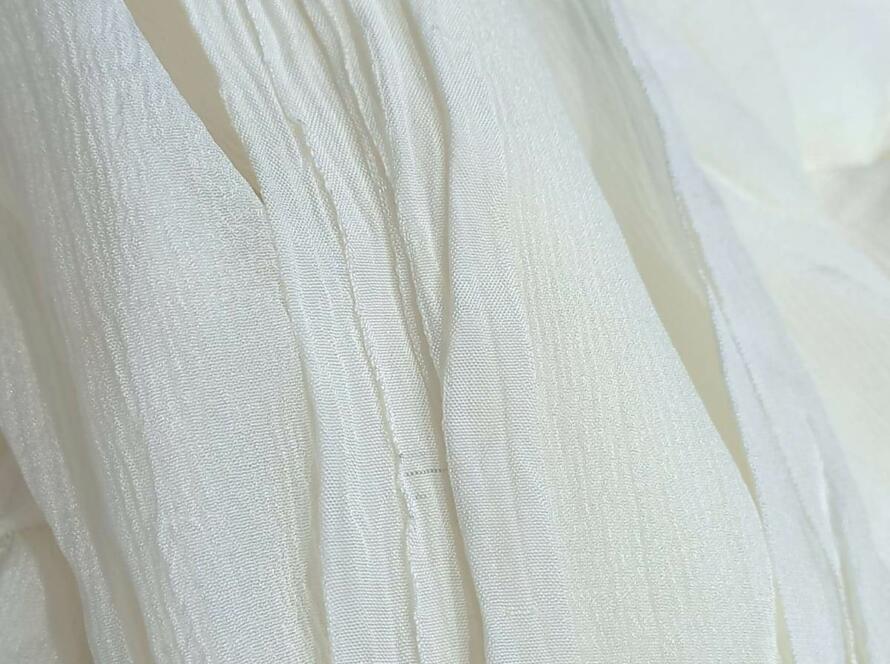

Intricate threads & premium texture Printed Fabric

Creative, colorful & always trending Position Printed Fabric

Perfect alignment for standout looks Jacquard Fabric

Rich textures with woven luxury Plain Dyeable (RFD)

Customize colors, your way Pure Dyed Fabrics

Ready-to-stitch brilliance Designer Dupattas

From shimmer to sheer elegance Ready Stocks

Quick ship fabrics in bulk Kurti Fabrics

Comfort meets tradition New Arrivals

Fresh drops, every week

A Global Perspective: What the World is Searching For

To understand how to source effectively, we must first understand how fabric demand varies across regions. Every country has its own style behavior, influenced by climate, cultural celebration, economy, and social identity.

For example:

• UAE & Saudi Arabia: Prefer luxurious drape fabrics like premium satin, royal velvet, and delicately embroidered georgette for abayas, kaftans, and evening gowns. Their market values elegance with modesty: fabric must flow but remain refined.

• Nigeria & Ghana: Fashion is bold, expressive, celebratory. Lace, heavy beadwork, crystal embroidery, and brightly patterned organza are central to wedding and ceremony clothing. Here, fabric is not just material; it is status, beauty, and pride.

• USA / Canada: Designers emphasize fabric performance: comfort, sustainability, and fit. They look for premium plain satin, linen, crepe, chiffon, netted bridal tulle, and controlled-shine sequins. Their market values construction quality more than decorative complexity.

• France & Italy: Global capitals of couture. Taste leans toward refined luxury, structured silhouettes, nuanced texture, and custom embroidery. They demand mill-verified consistency and heritage craftsmanship.

• Mexico / Brazil: Rich color psychology. Vibrant floral prints, flowing georgettes, light satins, tropical crepes for festive and resort wear.

This is not just market information.

This is a map.

A map of how fabric expresses identity across cultures.

FabricDiary does not just supply fabric.

It studies fashion language, globally.

The Core of FabricDiary: Personalization, Transparency, and Scalable Sourcing

In the global apparel supply chain, the most common breakdown occurs between demand clarity and supply capability. Designers know what they want, but mills cannot always translate those requirements at small volumes. Manufacturers require consistency and speed, but wholesale markets cannot guarantee replenishment. Importers and distributors require style diversity, but smaller suppliers offer limited breadth.

FabricDiary solves this through a dual-structured system:

- FabricDiary.com

A digital sourcing interface where buyers can browse catalogues, order samples, evaluate swatches, and purchase small-to-mid quantities without traditional MOQ restrictions. - Madhav Fashion Factory (India)

A vertically-integrated production ecosystem specializing in luxury embroideries, premium surface textures, custom dyeing, finishing treatments, and scalable replication for bulk orders.

This model addresses the three pillars of modern sourcing:

Variety: Hundreds of fabric bases, embroideries, prints, textures.

Flexibility: Start small, scale up when styles validate in the market.

Continuity: Guaranteed replenishment for running products.

For businesses in growth or transition, this flexibility is critical. It allows brands to test markets, refine collections, avoid deadstock, control risk, and scale responsibly.

How Fabric Preferences Emerge Across International Markets

Understanding fabric sourcing today means understanding cultural market identity. Fashion is no longer driven only by industry trends; it is driven by regional aesthetics + climate practicality + consumer psychology. Below is a concise analytical view of key markets:

| Region / Market | Consumer Drivers | Key Fabric Traits | Typical Applications |

|---|---|---|---|

| Middle East (UAE, KSA, Qatar) | Luxury positioning, modest silhouettes, evening culture | Soft drape, rich sheen, detailed embellishment | Abayas, Kaftans, Wedding & Evening Gowns |

| West Africa (Nigeria, Ghana) | Celebration-oriented dressing, visual identity | Lace, crystal work, weighty texture | Ceremonial outfits, Weddings, Aso Ebi |

| North America (USA, Canada) | Comfort + sustainability + fit | Crepe, Georgette, Satin, Linen, Tulle | Bridesmaids, Casual Elegance, Boutique Lines |

| Western Europe (France, Italy) | Couture heritage, texture-led sophistication | Organza, Tulle, Silk-blend textiles | Runway, Fashion Weeks, Bespoke Atelier |

| Latin America (Mexico, Brazil) | Color vibrancy + movement | Printed georgettes, floral satins, soft chiffons | Festive, Partywear, Resort & Beach Fashion |

This is the strategic difference FabricDiary brings:

We do not sell fabric generically. We map fabric to culture, market demand, and seasonal fashion cycles.

This is why the same fabric catalog is localized into curated selections for boutiques, studios, mid-size manufacturers, and importers across different regions.

This approach is market-driven, not seller-driven.

Product Capability Overview: What You Can Source

FabricDiary offers a complete spectrum suitable for both ready-to-wear and couture-level garment development:

Fabric Bases

- Georgette, Chiffon, Organza, Crepe, Satin, Velvet

- Linen blends, Silk blends, RFD bases for dyeing & printing

Surface Textures & Embroidery

- Multi-needle embroidery

- Mirror & sequin work

- Zari, resham, cording, laser-cut, thread craft, hand finishing

- Digital & screen prints (floral, geometric, abstract, heritage motifs)

Application Markets

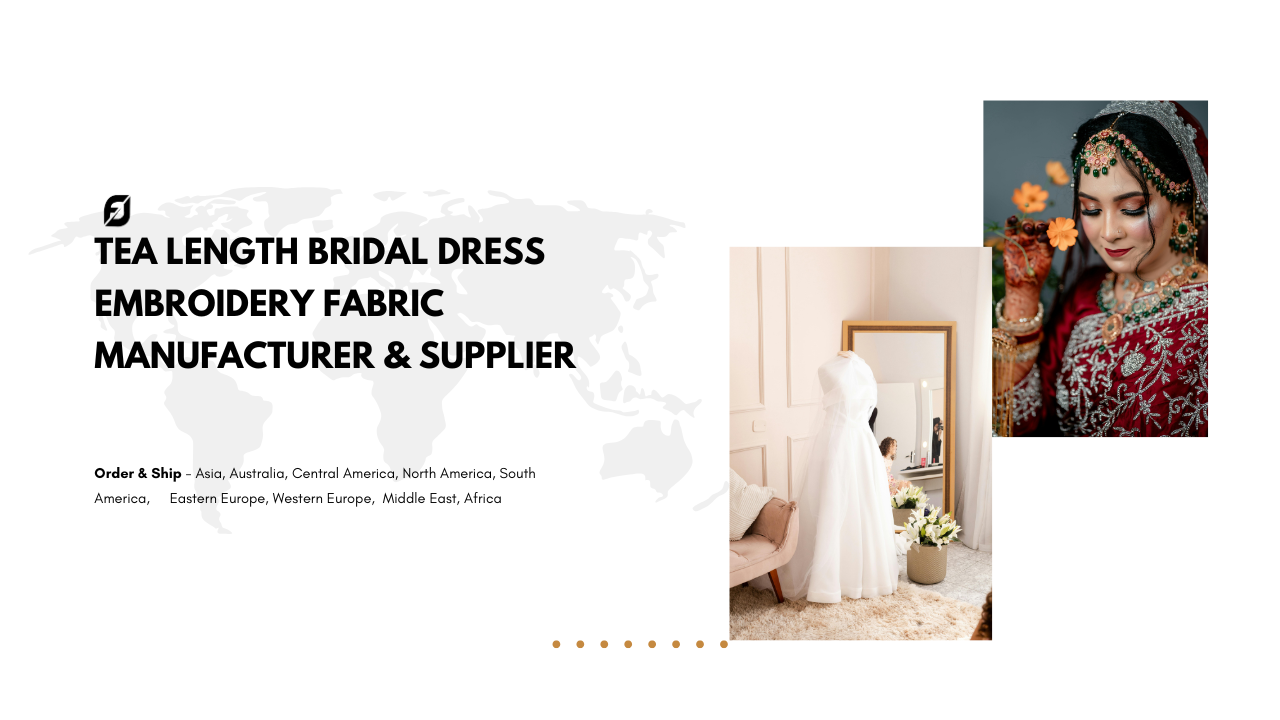

- Bridal wear

- Evening & red-carpet wear

- Luxury ready-to-wear

- Abaya / Kaftan collections

- Cultural & ceremonial attire

- Boutique capsule drops

- Small-batch testing before mass production

This ensures one sourcing point can support multiple collection categories, reducing procurement complexity and supplier fragmentation.

Comparison: FabricDiary vs Traditional Sourcing Channels

| Evaluation Factor | Local Wholesale Markets | Alibaba/Etsy | FabricDiary + Madhav Fashion |

|---|---|---|---|

| Order Flexibility | Limited | Varies | High (sample to bulk) |

| Quality Consistency | Unpredictable | Depends on vendor | Factory-controlled |

| Custom Color/Design | Rare & slow | Mostly unavailable | Fully supported |

| Communication & Follow-up | Manual | Indirect | Dedicated sourcing support |

| Product Variety | Season-bound | Vendor-specific | Trend-curated & scalable |

| Long-term Brand Alignment | Weak | Unstable | Strong & repeatable |

The key differentiator is continuity.

FabricDiary is structured for long-term sourcing relationships, not one-time transactions.

Real Business Value: Why Brands, Designers, and Manufacturers Choose FabricDiary

- Lower Market Risk

Start small → Test → Scale. This eliminates deadstock and failed inventory investment. - Faster Collection Development

Samples and approvals move through a simplified pipeline. - Clear Communication

Dedicated sourcing coordinators support technical clarity, order planning, and delivery scheduling. - Brand Identity Strengthening

Access to unique embroidery and surface design prevents catalog-style generic outputs. - Production Reliability

Factory capability ensures stable supply over time, critical for successful styles.

In an industry where relevance is defined season-to-season, sourcing must be agile, measurable, and repeatable. FabricDiary provides exactly that framework.

Case Studies: How Global Apparel Businesses Source Through FabricDiary

Case Study 1: Boutique Eveningwear Brand, Dubai (UAE)

A mid-size eveningwear label in Dubai faced challenges maintaining consistent fabric quality between collections. Their local wholesalers provided limited shade continuity, resulting in color mismatches between repeat production cycles. Additionally, high-MOQ import suppliers restricted their ability to experiment with new silhouettes in low quantities.

Sourcing Strategy with FabricDiary

• Began with 12-meter sampling orders of satin, organza, and georgette embroidered panels

• Approved textures and embroidery density through digital QC review

• Transitioned successful designs to 180–400 meter batch runs

• Color and finish continuity maintained through Madhav Fashion factory dye-house logs

Outcome

• Reduction in sampling and pre-production waste by 37%

• Faster design-to-rack turnaround (from 7 weeks to 4.5 weeks)

• Ability to launch seasonal capsule drops without bulk commitments

• Improved margin due to mill-level pricing and QC stabilization

Case Study 2: Bridal Gown Manufacturer, Toronto (Canada)

A North American bridal manufacturer required lightweight high-quality tulle, hand-embellished sequin nets, and controlled-sheen satin fabrics. Their previous overseas vendors lacked consistency across shipments, causing rework and increased rejection rates.

Sourcing Strategy with FabricDiary

• FabricDiary provided structured swatch books + embroidery density samples

• Approved shades were digitally stored under style codes for repeat orders

• Production shifted to Madhav Fashion Factory for embroidery replication

Outcome

• Fabric rejection rate dropped from ~11% to under 2%

• Procurement cycle became predictable, enabling standardized gown patterns

• Retailers reported improved fabric comfort scoring in consumer feedback

• Supply chain stabilized across 3 bridal seasons

Case Study 3: Occasionwear Distributor, Lagos (Nigeria)

A large distributor served wedding and ceremonial boutiques across Lagos. They required high-visibility lace and embellished fabrics that reflect cultural identity. Their challenge was re-ordering bestselling styles, which were often unavailable after selling cycles from local suppliers.

Sourcing Strategy with FabricDiary

• Identified top-performing lace and sequence work panels

• Reserved production capacity at Madhav Fashion for replenishable SKUs

• Introduced rolling dispatches to avoid inventory gaps

Outcome

• Distributor sustained trend continuity across multiple wedding cycles

• Maintained retail price stability due to controlled sourcing costs

• Built market reputation as a consistent style supplier, not trend-dependent

Ordering & Production Workflow (Clear Operational Understanding)

FabricDiary’s sourcing model is structured to reduce uncertainty. The process follows:

- Trend or Requirement Discussion

The buyer can send inspiration references, silhouettes, or mood boards. - Fabric Curation & Sample Dispatch

Swatches, surface textures, and color cards are shipped for evaluation. - Approval & Small Batch Runs

Small quantities (10–200 meters) allow pre-production fit testing and market feedback. - Bulk Production Transition

Once performance is confirmed, Madhav Fashion Factory replicates the approved material in volume. - Quality Control & Packaging

Every batch undergoes shade, GSM, drape, and embroidery consistency checks. - International Shipping & Documentation

All export compliance, packaging certifications, and logistics coordination are handled.

This process ensures controlled experimentation and reliable scaling.

FAQs

- Do you offer stable repeatability for running fabrics?

Yes. Shade logs and pattern files are stored for consistent reproduction. - What is the starting MOQ?

Sampling begins as low as 10 meters. Bulk MOQ depends on fabric category. - Can designs be customized for collections?

Yes. Embroidery density, color tone, motif scaling, and yarn type can be customized. - How is quality checked?

QC follows a multi-stage inspection protocol, including shade, weave consistency, finishing, and embellishment integrity. - Do you support brand-private labeling for exclusive fabrics?

Yes. Exclusive runs and locked patterns can be reserved for partner brands. - Is international shipping supported?

Yes. Shipments are handled to all countries with export-grade packaging. - Can we visit the factory?

Yes. On-site visits to Madhav Fashion Factory are available for bulk buyers and sourcing teams.

Global fashion is evolving, and sourcing models must evolve with it. Businesses today require suppliers who provide consistency, flexibility, and strategic insight, not just fabric inventory. FabricDiary offers a sourcing structure designed for modern apparel operations — experimentation, curation, and scalable execution.

For brands, manufacturers, distributors, and designers investing in long-term identity, the sourcing partner matters as much as the product.

This is where FabricDiary operates — not just as a supplier, but as an infrastructure partner in fabric strategy.